The promise of financial independence, being your boss, and earning a substantial income from the comfort of your home is a powerful lure. This allure is expertly manipulated by perpetrators of pyramid schemes, Ponzi schemes, and, in some cases, multi-level marketing (MLM) companies. While the dream of financial freedom is a valid one, it’s crucial for individuals, especially job seekers, to distinguish between a legitimate business opportunity and a fraudulent scheme designed to enrich a select few at the expense of the many.

Defining the Deception: Pyramid, Ponzi, and MLM

While often used interchangeably, these schemes have distinct characteristics. Understanding them is the first step in protecting yourself.

Pyramid Schemes: An illegal and unsustainable business model where participants make money primarily by recruiting new members, not by selling actual products or services. The money from recruits pays off the people who joined earlier. As the Federal Trade Commission (FTC) states, the structure is destined to collapse when it runs out of recruits.

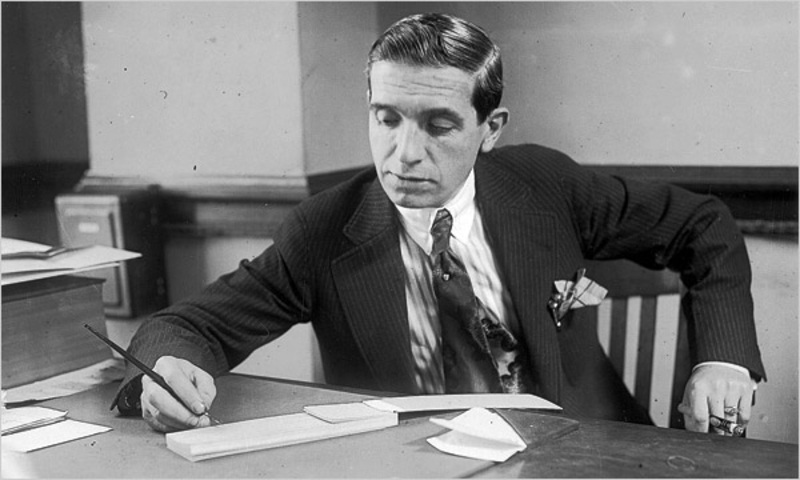

Ponzi Schemes: A fraudulent investment operation that pays returns to its investors from their own money or the money paid by subsequent investors. The scheme, named for swindler Charles Ponzi, creates the illusion of a profitable enterprise where none exists. The core difference from a pyramid scheme is that investors in a Ponzi scheme are typically not required to recruit new members themselves; they just believe they are making a legitimate investment.

Multi-Level Marketing (MLM): MLMs, also known as network marketing, involve selling products through a network of distributors. Distributors earn income from their sales and the sales of their “downline” (people they’ve recruited). The line between a legitimate MLM and a pyramid scheme can be blurry. The FTC advises that if a company’s revenue comes primarily from selling products to the public (not just to its members), it’s likely a legitimate MLM. However, these still carry significant risks, and a study on the FTC’s website found that over 99% of MLM participants lose money.

Case Studies in Deception: High-Profile Schemes and Their Aftermathhttps://www.google.com/search?q=https://www.ftc.gov/sites/default/files/documents/public_comments/trade-regulation-rule-concerning-business-opportunity-ventures-ftc.r511993-00008-57281.pdf

Scammers are creative, but their underlying models are often repetitive. Examining past cases reveals the patterns.

TelexFREE: The VoIP Scheme that Went Global

TelexFREE was a massive pyramid scheme that disguised itself as an MLM company selling a Voice over Internet Protocol (VoIP) phone service. The scheme, which defrauded over 1.8 million people worldwide out of more than $3 billion USD, was particularly devastating in Brazil, the United States, and the Dominican Republic.

How it Worked: The VoIP product was largely a front. The real business was in recruiting. Participants, called “promoters,” paid an initial fee to join. They then earned money in two main ways:

Recruiting new promoters into the scheme.

Spending a few minutes a day posting pre-written online ads for the VoIP service. For these simple tasks, they were promised annual returns of over 200%. The money from new investors was used to pay the “returns” of earlier participants. The US Securities and Exchange Commission (SEC) charged TelexFREE with being a pyramid scheme, noting that revenue from the actual VoIP product was less than 1% of the company’s total revenue. The rest came from recruits.

The Aftermath: Co-founder James Merrill was sentenced to six years in prison in the US. His partner, Carlos Wanzeler, fled to Brazil, where he was also eventually arrested. The collapse left a trail of financial ruin across multiple countries.

DMG Grupo Holding S.A.: The Pyramid that Shook Colombia

One of the most infamous pyramid schemes in Colombian history, DMG Group, led by David Murcia Guzmán, operated under the guise of selling prepaid cards for goods and services. It promised investors incredible returns of 70% to 150%.

How it Worked: People “invested” money by purchasing these cards. They were told that their money would magically grow and could be redeemed for a much higher value after a few months. In reality, DMG was a classic pyramid, using the massive influx of cash from new victims to pay off earlier ones. It had no legitimate business model to generate the promised returns.

The Aftermath: The scheme’s collapse in 2008 caused a national crisis, with riots and widespread social unrest. The Colombian government intervened, declaring a state of emergency and seizing the company’s assets. Murcia Guzmán was arrested, extradited to the US on money laundering charges, and later returned to Colombia to serve a lengthy prison sentence.

Generación Zoe: The Coaching and Crypto Cult

Based in Argentina, Generación Zoe, led by Leonardo Cositorto, blended elements of a Ponzi scheme with cryptocurrency and cult-like personal coaching. It promised investors guaranteed monthly returns of 7.5% to 10% in US dollars.

How it Worked: The organization attracted people by offering educational and spiritual coaching. Once inside, members were pressured to “invest” in various ventures, including a supposed gold mine and a self-named cryptocurrency called “Zoe Cash.” The scheme was a simple Ponzi: money from new investors paid the “profits” of the old ones. The coaching and crypto elements served as a modern, sophisticated facade.

The Aftermath: The scheme collapsed in 2022. Cositorto was arrested after being a fugitive, and he and other leaders were convicted of fraud. The case revealed losses of hundreds of millions of pesos, devastating communities across Argentina.

Inversiones 24K Ltda: The Bogus Gold Scheme

The Colombian Superintendency of Companies intervened in Inversiones 24K Ltda for the illegal collection of money. This company promised investors high returns based on investments in the gold market.

How it Worked: The company offered “investment contracts” where they pledged to pay investors a fixed monthly return. They claimed these profits came from their expert trading in the gold market. However, regulators found no evidence of any significant, profitable gold trading. The company was simply using money from new investors to pay returns to existing ones—the defining characteristic of a Ponzi scheme.

The Aftermath: The government agency suspended the company’s activities and ordered it to immediately return all illegally collected money, highlighting how regulators step in to stop such schemes once they are identified.

Other Noteworthy Cases

Mauricio Garcia-Franco: A Colombian national pleaded guilty in the U.S. to a multi-million dollar investment fraud scheme. He and his co-conspirators ran a Ponzi scheme, soliciting money for supposed investments in everything from real estate to COVID-19 masks, promising high returns they never generated.

Nariño Pyramid Scheme: A fraudulent scheme in the Nariño department of Colombia defrauded over 230 people. This smaller-scale but equally damaging local scheme promised massive returns on investments, collected over a billion pesos, and then vanished.

How to Spot a Scam: Red Flags

Scammers’ tactics evolve, but the warning signs are often the same:

Emphasis on Recruitment: The biggest red flag. If you are told that the best way to make money is to recruit others into the program, it is likely a pyramid scheme.

Promise of High, Guaranteed Returns: All investments carry risk. Promises of guaranteed, high returns are a classic sign of fraud.

Pressure to Act Quickly: Scammers create a sense of urgency (“This offer is for a limited time!”) to prevent you from thinking critically or doing research.

Complex or Secretive Strategies: If the company cannot or will not explain its business model in simple, clear terms, be very suspicious.

Required Upfront Investment or Inventory Purchases: Legitimate jobs don’t require you to pay to get started. MLMs that pressure you to buy more product than you can realistically sell often function like pyramid schemes.

A Note on Remote Work: A job offer is not a scam just because it’s remote. However, be extra vigilant. Legitimate employers will have a professional recruitment process and will never ask you to pay for your equipment upfront or invest in the company as a condition of employment.

Fighting Back: How to Report Scams

If you encounter a fraudulent scheme, report it. Your report can help authorities build a case and prevent others from becoming victims.

In the United States:

Federal Trade Commission (FTC): File a report at ReportFraud.ftc.gov.

US Securities and Exchange Commission (SEC): For investment fraud, report it to the SEC’s Office of the Whistleblower.

State Attorney General: Find your AG at the National Association of Attorneys General website.

In Latin America & The Caribbean:

Reporting mechanisms vary by country. You should contact the national police, the financial crimes unit, or the national financial regulator.

In Colombia, for example, you can report to the Superintendencia Financiera and the Fiscalía General de la Nación.

In Mexico, you can contact the Comisión Nacional para la Protección y Defensa de los Usuarios de Servicios Financieros (CONDUSEF).

Ponzi Schemes are named after swindler Charles Ponzi. Photo credit: Boston Library/Wikipedia.

Facebook Comments